AI + ASC: The Future of DeFi (part 2)

New Opportunities for ASC

Conventionally, currencies serve three purposes: a unit for keeping account, a medium of exchange and a medium to store value. Without a doubt, ASC also fulfills all these three functions too. Popular ASCs available in the market today have drawn inspiration from the way traditional central banks work. They are priced based on the supply and demand of the market, with fixed rules substituting subjective judgment, and algorithms taking the place of centralized institutions. Algorithms determine how many stablecoins will be issued, and the price is determined by supply. This is to say that as long as we can control the number of stablecoins issued, we can control its price, and that is the core advantage and value of ASC.

Given all this, to promote the application of ASC, we need to start from its intrinsic nature and purpose.

1. Innovation of mechanisms: We should not only pay attention to innovative staking mechanisms but also to innovative algorithm adjustment mechanisms;

2. Fundamental innovations: Currently, the issuance and management of stablecoins mostly depend on Ethereum. In addition to the Ethereum Mainnet, a layer-2 network can be added to accelerate the circulation and expand the use scenarios of ASC. Liquidity and a large number of application scenarios are the only guarantee for stability for any type of stablecoins;

3. Innovation of underlying assets: USD doesn’t have to be the only underlying asset that ASCs are pegged to. Using the local currencies of different markets will make ASCs easier to use for local people. This will help expand the application scenarios and user base of ASC, thus boosting its liquidity.

APEX: Fresh Blood for the Matrix DeFi Ecosystem

APEX (AI-Powered Exchange) is a decentralized protocol based on Matrix’s AI technology, supporting the minting and cross-chain exchange of multiple algorithmic stablecoins. By integrating AI with algorithmic stablecoin, APEX will create scalable decentralized stablecoins suited for the specific needs of different countries and regions, and support the free exchange among all types of stablecoins. Here are five core features of APEX:

a. Smart Stabilization Algorithm: Users need to stake a certain number of assets to mint algorithmic stablecoins. Smart stability adjustment is dependent on both stakes and stabilization algorithms. When the ratio between algorithmic stablecoins and the currency it is pegged to is bigger than 1 on APEX, the weight of stakes will decrease, and the weight of algorithms increase. When this ratio is smaller than 1, the weight of staking will increase, and that of algorithms decrease;

b. DAO: autonomous community, featuring decentralized management;

c. Cross-chain Transaction: Since APEX supports the exchange among algorithmic stablecoins on different blockchains pegged to different fiat currencies, the platform’s cross-chain functions are fully capable of facilitating the transactions of different types of assets;

d. On-chain Oracle Machine: APEX has direct access to the real-time data of DEXs and reads the real-time exchange rates of currencies through Chainlink;

e. AI-powered Currency Exchange: AI algorithms will help find the best exchange rates for different asset types on APEX. Users may also choose to ignore these AI recommendations and use any currency exchange service they prefer.

Essentially, APEX is about two things: 1. algorithmic stablecoins geared towards individual markets, and 2. an AI-algorithm-stabilized exchange built on Matrix AI Network.

APEX: A Better Solution for DeFi

A Smart Oracle Machine

The Oracle Machine is an integral part of DeFi. It is a one-way digital proxy capable of searching for and verifying real-world data and sending them as encrypted information to smart contracts. Without the Oracle Machine, DeFi contracts will be incapable of obtaining the necessary data for operation. The Oracle Machine is mainly responsible for processing requests from smart contracts and bringing information and data from outside onto the blockchain. Therefore, the Oracle Machine can be seen as the bridge between decentralized protocols and offchain data, and it will play a crucial role in supporting the wide variety of ASCs on APEX.

However, a centralized oracle machine can create all kinds of problems. Firstly, its source of price information won’t be diversified enough, and information from a centralized source may easily be replicated, altered or intercepted. Therefore, using a single centralized data source for the Oracle Machine is not only unwise but also dangerous. Corrupted or invalid data fed into a centralized oracle machine can cause serious damage to end-users.

Secondly, offchain data are not responsive enough to price fluctuations and thus not smart enough. The reason behind this is that privileged users need to be trusted to neither commit evil on purpose nor be coerced to send corrupted updates. Trusted messages can’t be accessed by any other privileged party, meaning that even when under attack, the system can do nothing to protect itself. Without a solution to this, losses can be devastating. This is not to say, however, that the attackers’ tactics are in any way sophisticated. Such attacks are only difficult to defend against because current oracle machines are not smart enough.

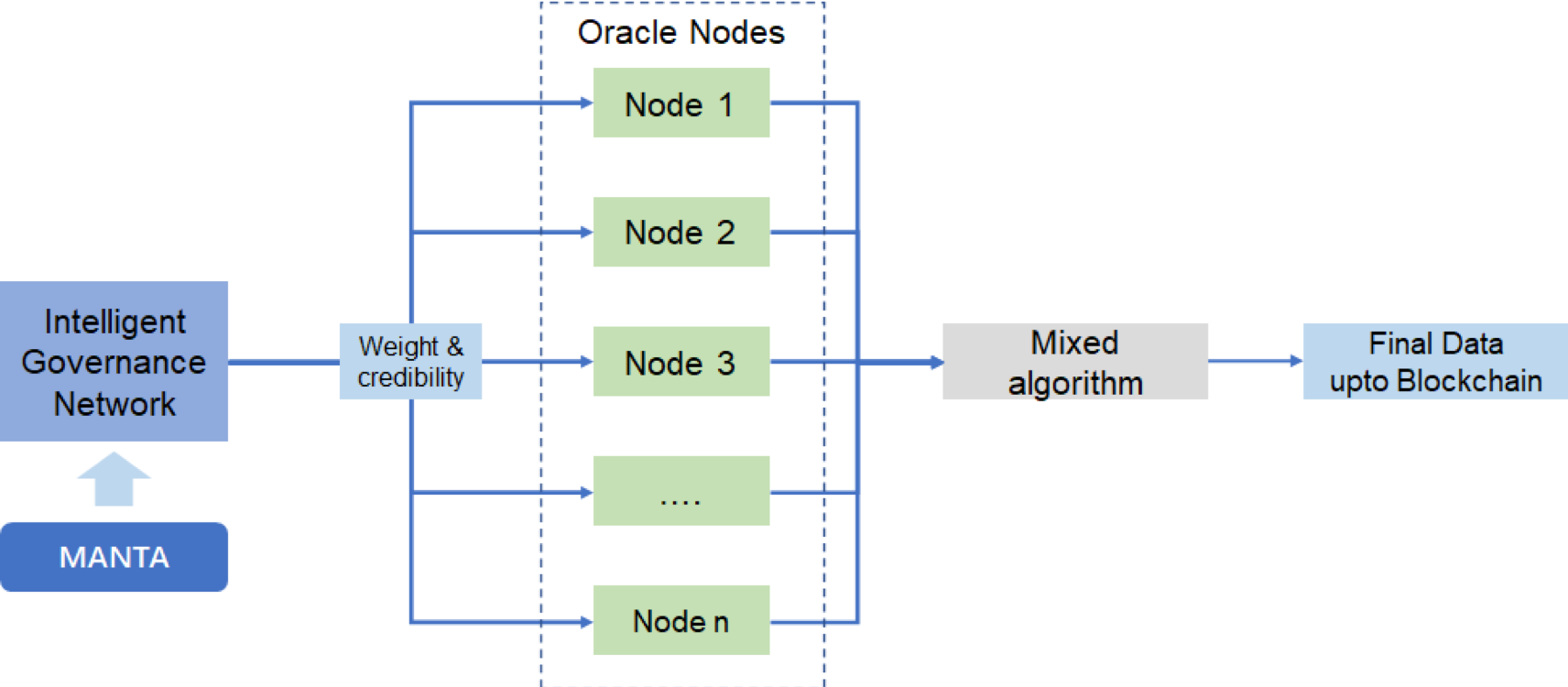

By building a revolutionary AI-powered oracle system based on Matrix AI Network, APEX is hoping to supplement traditional oracle machines with the power of AI. While guaranteeing there are always multiple nodes receiving offchain data, APEX also utilizes an onchain governance program capable of auto-machine learning based on Matrix’s MANTA platform. This program will automatically adjust the weight distribution to nodes and appraise the trust level of each node.

This way, the speed and stability of the Oracle Machine will drastically improve, and APEX will be much more secure and versatile enough to handle all scenarios.