AI + ASC: The Future of DeFi (part 3)

Smart ASC Trading Platform

Since APEX hosts ASCs for different countries and regions, people will frequently want to exchange one ASC into another just as in a foreign exchange market. Conventional transaction methods will have a difficult time keeping up with the volatility of niche markets, and cross-chain transactions make it even harder to secure the best prices for users.

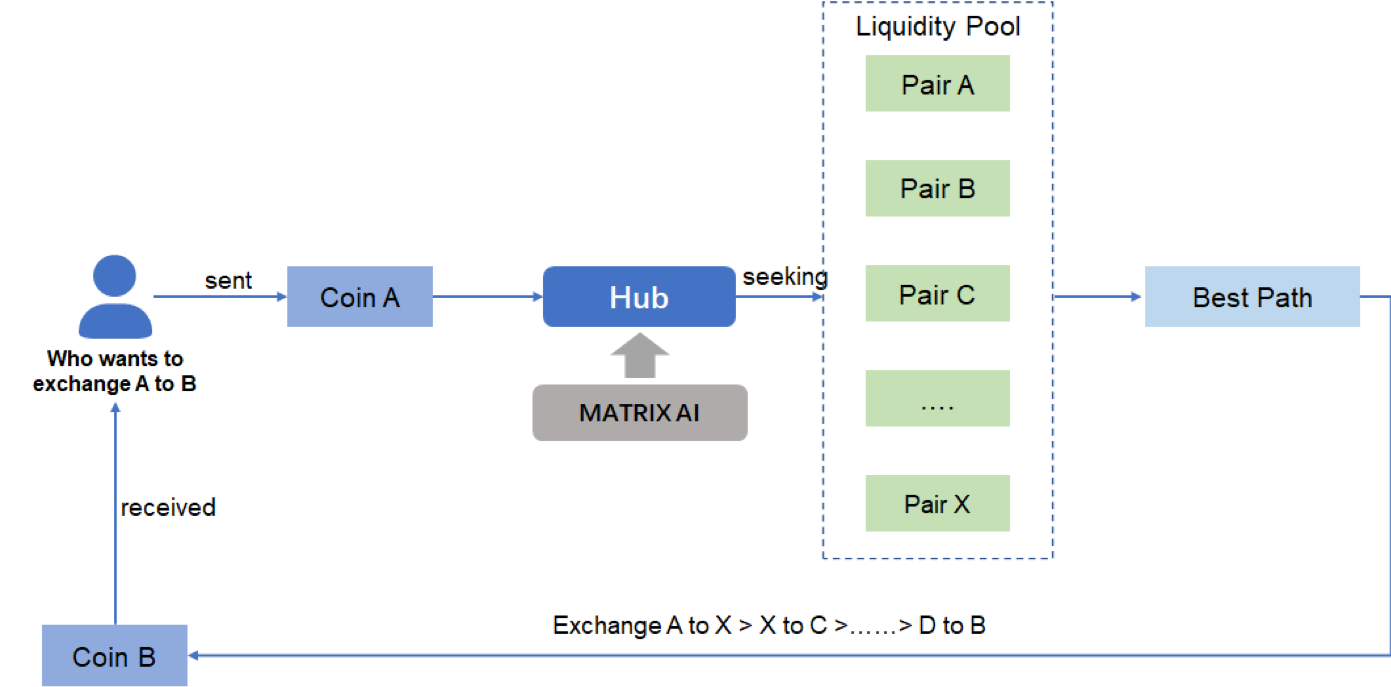

To solve this problem, APEX will offer a cross-chain router hub to facilitate the exchange of ASCs on APEX or between APEX and other blockchain platforms. When a transaction request is launched, the Oracle Machine will snatch real-time price information from the liquidity pools on the respective blockchains of each underlying asset. The Oracle Machine will send this information to Matrix’s AI exchange protocol. Combining all information, the protocol will help users find the best price and pick the optimal transaction route. Once a transaction is confirmed, users pay with ASCs they have on one blockchain and receive ASCs on the target blockchain.

As APEX hosts multiple ASCs whose price movements create opportunities for arbitrage in a market that is open 24/7, a quantitative trading strategy tool based on Matrix AI will be provided for users who are interested in arbitrage through high-frequency trading.

Why Is ASC Significant for Matrix?

A Diversified DeFi Ecosystem

Digital assets are a crucial part of a public chain’s worth, and financial tools can boost the use and liquidity of digital assets, thus raising their value.

ASC is a fundamental part of DeFi, and APEX will lay the foundation for Matrix’s DeFi ecosystem.

Stable Pricing

AI services and computing power leasing will become Matrix’s core services. All the services on Matrix AI Network will require MAN for payment, which is expected to boost MAN’s liquidity. However, it will be difficult to commercialize these services, not to mention promote them to clients outside the crypto industry, if the services are priced in a volatile currency. The fluctuating price of MAN could become a barrier for ordinary corporate clients or individual users who may otherwise be interested in the services and computing power Matrix offers.

Therefore, to provide users a streamlined experience, Matrix will need to introduce stablecoins to price its services. Although USDT could be a good choice, it is a centralized stablecoin and thus at odds with our ideal for a decentralized platform. There may also be unforeseen risks associated with centralized assets, and truly decentralized stablecoins are the solution.

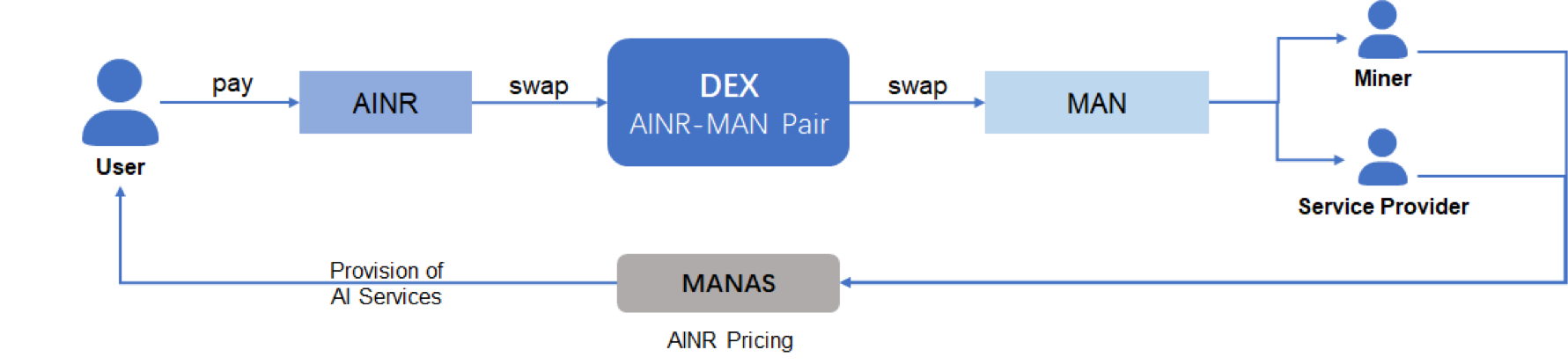

Take the Indian market as an example. Services on MANAS will be priced in AINR in India. When users want to buy services on MANAS, they pay in AINR, and the system will automatically convert the AINR into MAN through DEX. This payment will go into the accounts of all providers of algorithms and computing power necessary for running this service. This solution removes the entry barrier for users and guarantees the liquidity of MAN.